Last week, I was meeting with a thirty-something, successful business owner and we were discussing college for his two young daughters. I feel compelled to share with you who he is as a daddy, not a mommy. As you walk into his downtown Miami office you find a mixture of business accolades resembling something of a family shrine. An entire wall is covered with his daughters’ art work, family pictures, handwritten letters from his eldest, and even a love letter from his wife. Every time we meet to talk finance, I sit and admire the smiles the family shares and the bond between a father and daughter. I can only describe it as the perfect love. Furthermore, I admire the fact that he reserves the weekends as much as he can to spend time with his family. He has built a good business and put in the work ethic to have earned what he owns. If you ask him, he defines himself by providing happiness, wellbeing and opportunity for his family. Now, you may be pulling out the handkerchief, shedding a slight tear and thinking “how sweet.” Right… probably not because your family operates similarly.

As we were discussing various contribution plans, he stopped the conversation and said, “Alexia, I am concerned with the cost of their education.” Okay, this was an unexpected revelation so I stayed quiet hoping to gain perspective. I watched him as his expression changed and became somber. I listened intently. His “costs” were described as support for a stay-at-home mom, preschool, after school activities, clubs, formal private schooling until college, and the millions of other things that he feels compelled to provide for his daughters and wife. His parents had provided their best and gave him tremendous opportunities; he wants to do the same. I sat back in my chair and had an emotional moment of clarity because this man GETS it. Many parents are compelled by different things, whether it was a parent who provided well or ones that did not. For him, it is a family legacy he wants to ensure.

Save For College

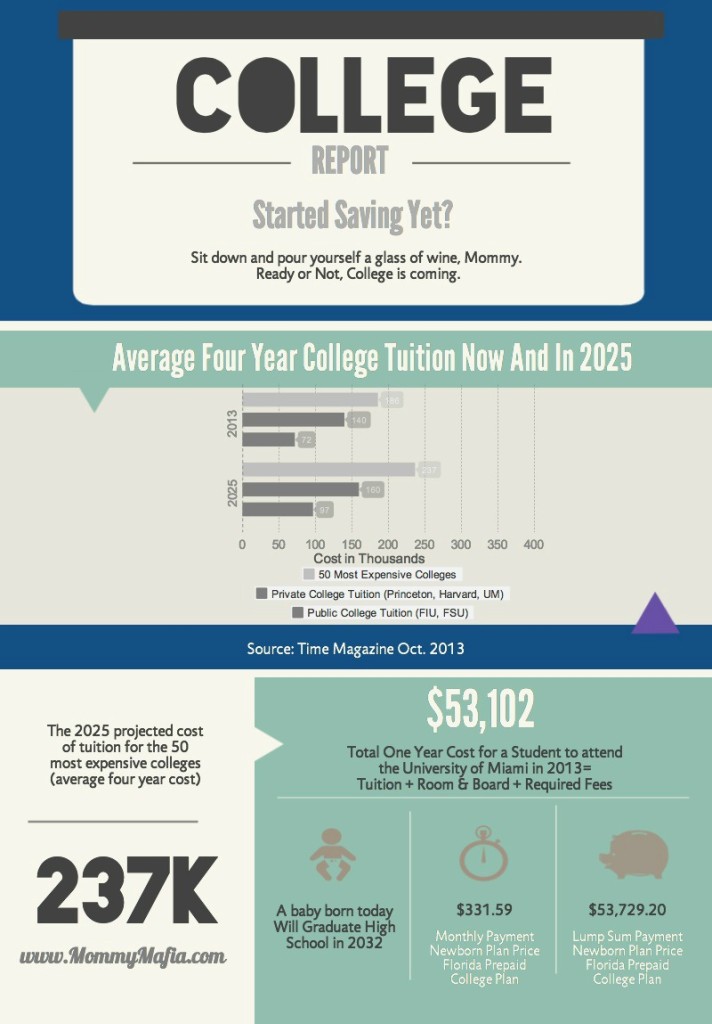

We constantly come across “Save For College” articles enlightening us on the range of college education costs, including instate, out of state, private, and advanced degrees. And let’s not forget the extended 5 and 6-year diplomas due to a change of heart on the best-suited career. Yes, we humans do have a knack for changing our minds. In this specific situation, the father I was speaking to agreed that the heightened cost of education would start at high school for his daughters and continue on to adulthood. The new timing for his plan was not 15 years but more like 12 years. I guess this throws a big fat wrench where the real cost of living/education is in this town. This is hugely underestimated by most of my clients. Tabling the college-planning topic for a more calm time always puts people at a disadvantage because the miracle of compounding interest requires time. I just sent payments off for another client for the University of Miami totaling $60K for one child. Good thing she has a large company with funds because her numbers did not match up with what the University of Miami deems as the equitable fees for 2013. Her son’s UM experience will cost her anywhere from $240K to $260K. The rising cost are anywhere from 3-5% per year. Yes dear reader, drink some bubbly and take it all in as these are the signs of our times.

There are so many options out there anyone’s well-attached head is likely to spin with Google’s thousands of options. Professionally it isn’t appropriate to generalize and say this plan is good and this one is bad. Beauty is relative to the person and situation as are these plans. My clients represent the top 5% income earning bracket in the US, so nothing is cookie cutter.

There are so many options out there anyone’s well-attached head is likely to spin with Google’s thousands of options. Professionally it isn’t appropriate to generalize and say this plan is good and this one is bad. Beauty is relative to the person and situation as are these plans. My clients represent the top 5% income earning bracket in the US, so nothing is cookie cutter.

Let’s look at the top 3 things I address with my clients with regards to saving for college tuition and costs:

1. Do they know what university their child will attend? Someone with a baby might laugh at the seemingly silly question guessing into the future. Don’t get mad at me quite yet, I’m trying to make a point. Most of my clients don’t know what college their children will attend so picking a restrictive plan that places regional limitations is like being that dot outside the circle of trust. With my love of food, I’m sure I’ll have that one son that decides to go study in France like his mother, in hopes of becoming a chef. Rough Euro conversion, ouch.

2. What things do they want to have covered as acceptable educational expenses under their plan? Most of my clients want to cover tuition, room and board, books, and just about anything that is college related like sorority fees, spring break and that studio off campus in Berkley. Drink up that bubbly. Oh yeah and a car! Well, the education to my clients happens when they realize some plans cover only a couple of allowable expenses via their plan. So one might ask, why get it in the first place, because it was sold as a tax advantage account to grow money without discussing what it actually covered. I will pass on this generalization; most of my clients have a multi-plan approach to cover all bases for all kids.

3. Have they thought about a self-completing plan? Many of my clients operate in a household with a stay-at-home wife and a primary bread-winning husband or are single parents with parental sharing with an ex. They save for college amongst other things like financially responsible people. But what happens when one of the parents isn’t here anymore? The topic no one likes to address and is the highest concern for my women clients. The concern that describes an underinsured husband or wife. I recently had the privilege of helping an inspiring widow and kids liquidate assets to ensure the family’s survival and college dreams. However, professionally, I understand what power that would have been provided with the correct amount of life insurance. Make sure you have the correct amount!

The list is long with other things to consider. My last piece of advice is to not go about this alone. Find a trusted advisor to dive in deep with your family. College is supposed to be fun and full of memories. Let’s help our future graduates walk out of college with a strong education and no debt, which in my personal opinion one of this country’s biggest tragedies. Land of opportunity is what my clients want to bestow on their generation. What do you want to do?

About Alexia Gonzales

Daugther. Sister. Fiancee. Believes in developing strong women by disrupting the stodgy status quo of women in respect to their financial planning. Founder of “My Man is not my Plan” community and blog. Equality advocate. Joy seeker. Sleep evangelist.

Thanks for shedding light on parent’s being concern for their children’s well-being. It was an eye opening when you disclose the facts about the increase cost for college. I will definitely be calling you to invest in the future of our children, thanks. Danize Diaz mom in Tiniciti

I’m glad you found it interesting, Danize! It’s pretty scary when you stop to think about how expensive college will be. But it’s great that you are ready to start investing now!

Danize, college is overrated and I regret pouring any amount of money into what was basically a waste of time into about a 120 credits of IT courses in which I, for the most part, knew more than the instructors. I did get to take up advanced math again and easily ran through it, and this is likely why I am so much better at managing money than you. Unfortunately, you are the furthest thing from being an astute believer in “My Man Is Not My Plan” as you have, since writing on this blog, exhausted a large portion of my savings since moving back in with me. You live rent, utility, and, for the most part, food free but yet have not a single dime to show for it. I doubt you will ever have any money whatsoever to invest in our children’s future. On the positive side, our kids may actually learn the value of money by seeing your example of how you squandered so much of it and hope not to follow in your path.

When I attended St. John’s University in NY and graduated back in 2005 the tuition was just under $20k per year. My son just got accepted and the tuition is now $40k per year. It has doubled in less than 10 years. It’s outrageous.